Affordable Auto Liability Insurance

Protect Your Ride with GM Auto Insurance

Discover comprehensive liability coverage that fits your budget. Get peace of mind on the road with our tailored insurance solutions.

Get Free Quotes Now!

What Liability Insurance Really Covers

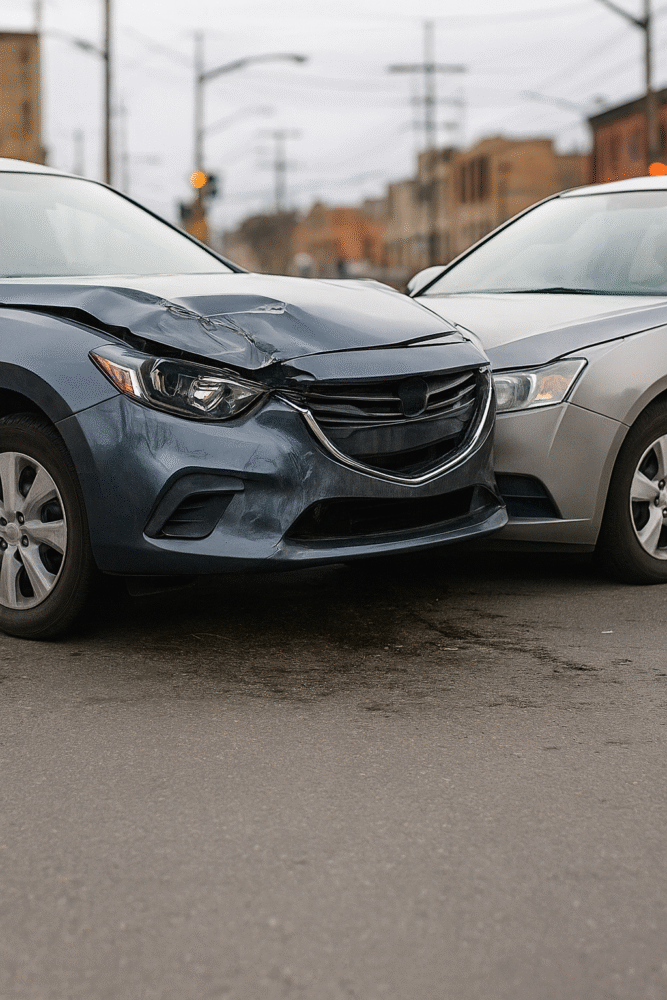

Liability insurance is the backbone of your auto policy. It protects you when you’re responsible for an accident by covering the other party’s medical bills, vehicle repairs, and legal costs. It won’t fix your own car, that’s what collision and comprehensive are for, but it will shield you from the financial fallout that can turn a simple mistake into a serious burden. This is the coverage every driver needs, every day, because accidents don’t give you time to prepare – they just happen.

Why It Matters

A strong liability policy keeps your life moving. One crash can lead to thousands in unexpected costs, and this coverage is what keeps those bills from landing on your doorstep. GM Auto Insurance focuses on dependable protection, straightforward limits, and service that’s there when you need it most. It’s the traditional, tried-and-true layer of security that keeps families safe and businesses steady on the road ahead.

Common Questions About Auto Liability Insurance

Find answers to your most pressing questions about auto liability coverage and how it works.

What is auto liability insurance?

Auto liability insurance covers damages or injuries you cause to others in an accident. It is a legal requirement in most states.

How does liability insurance differ from full coverage?

Liability insurance only covers damages to others, while full coverage includes protection for your own vehicle as well.

What factors affect my liability insurance rates?

Factors include your driving record, age, vehicle type, and location. Discounts may apply for safe driving and other criteria.

Can I get liability insurance if I have a poor driving record?

Yes, although rates may be higher. We offer options to help you find affordable coverage despite past issues.

How can I lower my liability insurance costs?

Consider bundling policies, maintaining a clean driving record, and exploring available discounts for additional savings.

What should I do after an accident?

Ensure safety first, then exchange information with the other driver and report the incident to your insurance provider promptly.

Why Choose GM Auto Insurance?

Comprehensive Coverage

Our liability insurance provides extensive coverage options to protect you and your vehicle in any situation.

Affordable Rates

We offer competitive pricing tailored to fit your budget without compromising on quality.

Quick and Easy Quotes

Get real-time quotes in minutes with our user-friendly online platform, designed for your convenience.

Exceptional Customer Service

Our dedicated support team is available to assist you with any questions or concerns, ensuring a smooth experience.

Choosing the Right Liability Limits

Liability coverage isn’t one-size-fits-all. Every driver has different needs, and the right limits depend on your vehicle, your driving habits, and your financial protection goals. State minimums might keep you legal, but they rarely offer the real security families and businesses need. Stepping up to higher limits can protect your savings, your assets, and your peace of mind if a serious accident ever occurs.

At GM Auto Insurance, we guide you through these choices without the sales pitch. You’ll get clear recommendations based on what actually protects you—not what pads a policy. It’s a grounded, traditional approach to insurance: honest value, strong coverage, and a plan built for the long road ahead.

Get Your Free Auto Insurance Quote Today!

Unlock the best auto insurance rates with GM Auto Insurance. Begin your journey to savings by starting your free quote now. It’s quick, easy, and tailored just for you. Don’t wait—secure your peace of mind today!